Introducing Capital Architecture: The Operating Model Private-Market Firms Have Been Missing

Private-market firms are entering a new era. Capital is more selective. Investor expectations are higher. The operational demands around transparency, reporting, and communication have risen significantly.

Yet most firms are still approaching capital formation the way they always have: a combination of relationships, hustle, and a patchwork of efforts spread across IR, marketing, finance, operations, and leadership.

This model worked when the firm was smaller.

It stops working when the firm begins to scale.

Leaders feel the shift before they can describe it:

“We’re growing, but capital feels harder.”

“We’re doing more, but results aren’t consistent.”

“Everyone is busy, but investors aren’t moving.”

“We have strong pieces, but they’re not working together.”

This isn’t failure.

It’s the signal that the firm has reached a new stage — one where capital can no longer depend on personalities, isolated activities, or unstructured processes.

This is the moment where Capital Architecture becomes essential.

Why Capital Formation Needs a New Operating Model

The private markets have outgrown the old language: investor relations, business development, marketing, fundraising.

These functions describe tasks and roles.

But capital formation today is no longer task-driven — it’s system-driven.

Investors expect:

consistency

transparency

operational maturity

timely reporting

clear communication

alignment across functions

preparedness for institutional or mid-tier capital

Inside most firms, these responsibilities live across different teams with different incentives, different information, and different priorities.

It’s no surprise capital often feels unpredictable.

Capital doesn’t break because teams are underperforming.

Capital breaks because the system underneath capital formation was never designed to scale.

This is the gap the industry has lacked language for — until now.

What Is Capital Architecture?

Capital Architecture is the operating model that brings clarity, alignment, and structure to private-market capital formation.

It integrates strategy, communication, reporting, operations, and investor experience into one coherent system.

It’s not a role.

It’s not a funnel.

It’s not a set of tactics.

It is the architecture that sits beneath all of it. It’s the system that makes capital predictable, not reactive.

Capital Architecture exists because of a simple truth:

Capital doesn’t scale through activity. Capital scales through structure.

This discipline brings together everything a firm has built — performance, track record, brand, investor relationships, communication rhythms — and aligns them into a unified engine capable of supporting the next stage of growth.

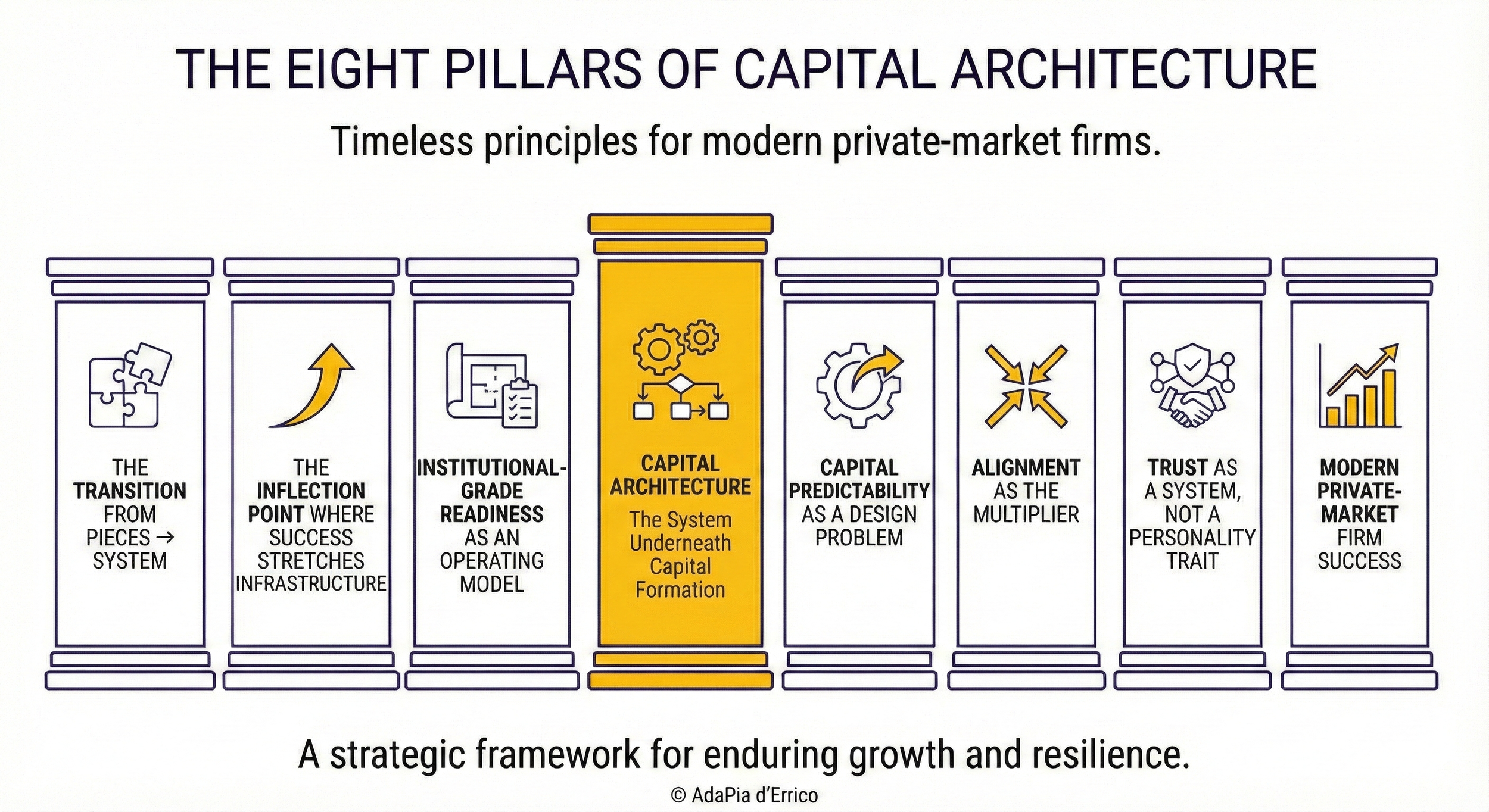

The Eight Pillars of Capital Architecture

The foundation of Capital Architecture is built on eight structural principles — recurring truths observed across private credit, private equity, real estate, alternatives, fintech, and private placements.

These Pillars are not theoretical.

They reflect how capital behaves in private markets.

For a full overview of each of the eight pillars of capital architecture, read this post.

These principles form the backbone of the category.

Every firm that grows beyond early-stage fundraising eventually encounters each of them.

Why This Category Matters Now

Private-market growth has outpaced the design of private-market systems.

Firms today need an operating model that can withstand:

increased investor sophistication

faster diligence cycles

more competitive capital environments

multi-channel capital strategies

the rise of “missing middle” capital partners

the expectations of family offices, RIAs, and mid-tier institutions

the leadership strain caused by fragmented capital functions

Capital Architecture meets that need.

It brings discipline, consistency, and predictability to capital formation — without stripping away the relational, human aspect that defines private markets.

It’s not about removing the founder.

It’s about removing the founder from the friction points that prevent scale.

What Capital Architecture Enables

When a firm adopts Capital Architecture, the shift is immediate:

inflows stabilize

investor communication becomes coherent

reporting becomes timely and credible

alignment strengthens across IR, marketing, finance, and operations

investor confidence increases

leadership gains clarity

capital becomes a designed system, not a moving target

Capital Architecture takes strong pieces and turns them into a scalable whole.

It transforms capital formation from a reactive effort into a predictable engine.

A New Standard for Private-Market Leaders

Capital Architecture is more than a framework. It is a category.

It defines the next stage of maturity in private-market capital formation.

It gives leaders the language to describe the system they’ve always needed but never had a name for.

And it provides the foundation for firms that want to scale with integrity, clarity, and operational excellence.

This is not a theory.

It’s the lived pattern of how private-market firms evolve when they are truly ready for their next stage.

Capital Architecture is the operating model for that evolution.

If your firm has strong pieces and you’re ready to understand what the next level of alignment looks like, I’m happy to connect. A brief conversation can map where your system is supporting you — and where it’s quietly limiting scale.